Rolex Rings: A Business Model Success Story

Share

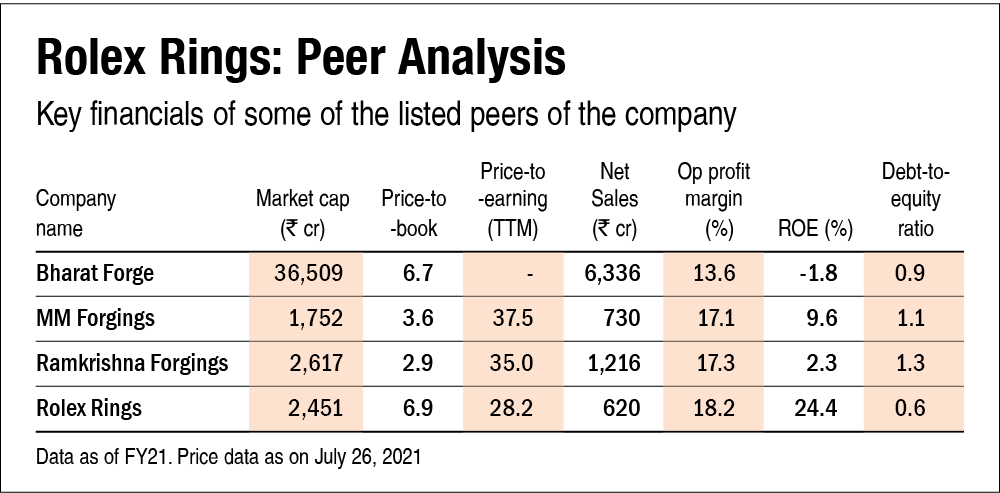

Rolex Rings Ltd., an acclaimed manufacturer in the realm of forged and machined components, stands as a paragon of resilience and strategic growth within the industrial sector. The company's innovative business model and meticulous operational management have carved a niche for it in both domestic and international markets. This article delves into the unique aspects of Rolex Rings' business model and its application in the broader business landscape, offering valuable insights for industry professionals and investors alike.

Source: Value Research Online

The Genesis of Rolex Rings

Founded in 1983, Rolex Rings Ltd. began its journey as a modest enterprise focused on producing bearing rings and automotive components. Over the decades, the company has evolved through strategic expansions, technological upgrades, and market diversification. The IPO launch in 2021 marked a significant milestone, underscoring its robust financial performance and long-term growth potential Valueresearchonline IPO Analysis.

The company has successfully navigated the complexities of the industrial sector, overcoming challenges posed by economic fluctuations and market volatility. Its ability to adapt and innovate has been pivotal in maintaining its competitive edge. The history of Rolex Rings' growth is not just a tale of business acumen but also a testament to strategic foresight and operational excellence.

Core Components of Rolex Rings' Business Model

Diverse Product Portfolio

Rolex Rings Ltd. boasts a comprehensive range of products catering to automotive, industrial, and aerospace sectors. The diversification into different segments has enabled the company to mitigate market risks and stabilize revenue streams. By continually expanding its product lines, Rolex Rings ensures it meets the evolving demands of its clientele MoneyWorks4Me Company Info.

Strategic Market Positioning

The company’s market positioning is a blend of cost leadership and differentiation. By leveraging cost-efficient manufacturing processes and high-quality standards, Rolex Rings delivers value to its customers. Its strategic focus on both domestic and international markets has fortified its presence, making it a preferred supplier for major automotive manufacturers globally.

Financial Performance and Resilience

A crucial aspect of Rolex Rings' business model is its financial prudence and resilience. Despite the challenges such as rising raw material costs and supply chain disruptions, the company has managed to sustain growth. For instance, in Q2 2024, while the revenue surged due to higher automotive demand, profit margins faced pressure, prompting the company to adopt cost-saving measures Markets Mojo Q2 2024 Analysis.

ESG Initiatives and Sustainability

Rolex Rings has embraced Environmental, Social, and Governance (ESG) practices as an integral part of its business strategy. The company’s commitment to reducing its carbon footprint, managing waste, and promoting energy efficiency has been recognized by various ESG rating agencies. These initiatives not only enhance its market reputation but also attract socially conscious investors Sustainalytics ESG Rating.

Source: Value Research Online

Case Study: Rolex Rings and the Automotive Sector

One of the most illustrative examples of Rolex Rings' business model in action is its engagement with the automotive sector. The company supplies critical components such as bearing rings to leading automobile manufacturers. This sector, characterized by stringent quality standards and intense competition, provides a challenging yet rewarding market.

Operational Efficiency and Quality Control

Rolex Rings employs advanced manufacturing techniques and rigorous quality control processes. The company’s facilities are equipped with state-of-the-art machinery, ensuring precision and consistency in production. This focus on operational efficiency not only reduces costs but also enhances product reliability, a crucial factor for automotive clients.

Strategic Partnerships and Client Relations

Over the years, Rolex Rings has forged strong relationships with major automotive players, becoming a trusted partner. These relationships are built on mutual trust and consistent performance, enabling the company to secure long-term contracts. The strategic partnerships have also facilitated knowledge sharing and innovation, further strengthening Rolex Rings' market position.

Adaptability and Innovation

The company’s ability to adapt to market changes and innovate continuously has been instrumental in its success. For example, the shift towards electric vehicles (EVs) has prompted Rolex Rings to develop components suited for EV applications. This proactive approach ensures the company remains relevant and competitive in a rapidly evolving industry.

Future Outlook and Strategic Considerations

Expansion and Diversification

Looking ahead, Rolex Rings plans to expand its product lines and explore new markets. The company is investing in technology and capacity expansion to meet the growing demand. This strategic expansion not only opens new revenue streams but also spreads market risks across different segments Finology Company Analysis.

Embracing Digital Transformation

Digital transformation is another critical area of focus. By integrating advanced technologies such as IoT and AI into its manufacturing processes, Rolex Rings aims to enhance productivity and efficiency. This technological leap is also expected to improve data analytics capabilities, providing deeper insights into operational performance and market trends.

Sustainability and ESG Integration

As sustainability becomes increasingly important for investors and consumers, Rolex Rings is poised to further integrate ESG considerations into its business model. The company’s ongoing efforts in this area will likely yield long-term benefits, both in terms of market reputation and financial performance.

Valuable Insights and Actionable Takeaways

For businesses and investors, the success story of Rolex Rings offers several valuable insights:

- Diversification: A diverse product portfolio can mitigate market risks and ensure stable revenue streams.

- Strategic Positioning: Balancing cost leadership with quality differentiation can create a competitive edge.

- Financial Prudence: Maintaining financial health and resilience is crucial, particularly in volatile markets.

- Sustainability: Integrating ESG practices is not only ethical but also beneficial for attracting investors and enhancing market reputation.

- Innovation and Adaptability: Staying ahead of market trends through innovation and adaptability can secure long-term success.

For those interested in exploring Rolex Rings' products, including their renowned rings, visit Wear Fortune's Rolex Ring Collection. This strategic insight into Rolex Rings' business model underscores its potential as a robust and sustainable enterprise, offering a blueprint for success in the industrial sector.